The STOXX Europe 600 index stands as one of the most comprehensive benchmarks for European equities, encompassing 600 of the largest companies across 17 countries. Its performance is closely watched by investors, analysts, and policymakers alike, as it reflects the broader economic health and market sentiment within Europe. Fintechzoom.com, a prominent financial news and data platform, offers detailed insights and analysis on the STOXX 600, providing valuable perspectives that help market participants make informed decisions.

This article delves into Fintechzoom.com’s recent coverage of the STOXX 600 index, exploring key themes, market drivers, and analytical approaches that shed light on the index’s performance. By dissecting these insights, readers can gain a deeper understanding of the factors influencing European equities and the broader investment landscape.

Understanding the STOXX Europe 600 Index

Composition and Significance

The STOXX Europe 600 is designed to represent large, mid, and small capitalization companies across diverse sectors in Europe. It includes firms from countries such as the United Kingdom, Germany, France, Switzerland, and the Netherlands, among others. This broad coverage makes it a vital tool for gauging the health of the European equity market.

Unlike more narrowly focused indices, the STOXX 600 captures a wide spectrum of industries, including financials, healthcare, industrials, consumer goods, and technology. This diversity offers investors a balanced view of the European economy’s performance and helps mitigate sector-specific risks. The index is periodically reviewed and adjusted to reflect changes in market capitalization and sector representation, ensuring that it remains relevant and accurately reflects the current economic landscape.

Moreover, the index’s methodology incorporates a free-float market capitalization approach, which means that only shares available for public trading are considered. This aspect enhances the index’s accuracy in representing the market and provides a more realistic picture of the investment opportunities available to investors. The inclusion of companies from various sectors also allows for a more comprehensive analysis of economic trends, as shifts in one sector can be balanced out by stability or growth in another.

Why Investors Monitor the STOXX 600

For institutional and retail investors alike, the STOXX 600 serves as a benchmark for portfolio performance and a barometer for economic trends. Fund managers often use it as a reference point when constructing European equity portfolios or assessing market conditions. Additionally, the index’s liquidity and transparency make it a popular underlying asset for exchange-traded funds (ETFs) and derivatives.

Given Europe’s economic complexity and the varying growth trajectories of its constituent countries, the STOXX 600 provides a consolidated snapshot that can reveal emerging opportunities or risks. Fintechzoom.com’s analysis helps interpret these signals, offering clarity amid the market’s inherent volatility. Investors often look to the index for insights into macroeconomic indicators such as GDP growth, inflation rates, and employment figures, which can influence market sentiment and investment strategies.

Furthermore, the STOXX 600 is frequently used in academic and financial research, as it offers a rich dataset for analyzing market behavior and investor psychology. Researchers may study the index to understand the impact of geopolitical events, regulatory changes, or technological advancements on stock performance. This makes the STOXX 600 not just a tool for investment, but also a valuable resource for those seeking to comprehend the intricate dynamics of the European financial landscape.

Fintechzoom.com’s Analytical Approach to the STOXX 600

Data-Driven Market Commentary

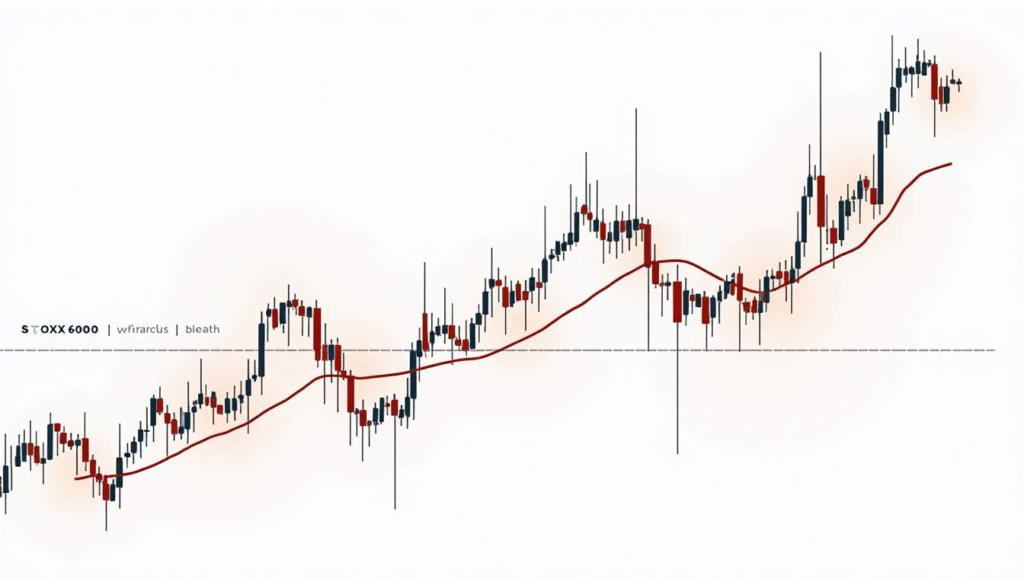

Fintechzoom.com employs a data-centric approach to market analysis, leveraging real-time price movements, volume trends, and historical performance metrics. Their coverage of the STOXX 600 often includes detailed charts and technical indicators, such as moving averages, Relative Strength Index (RSI), and Bollinger Bands, to identify momentum shifts and potential turning points. This meticulous attention to data not only aids in short-term trading strategies but also equips long-term investors with the insights needed to make informed decisions based on market cycles.

This quantitative perspective is complemented by qualitative assessments, where macroeconomic events, geopolitical developments, and corporate earnings reports are integrated into the narrative. Such a holistic view enables Fintechzoom.com to provide nuanced insights that go beyond surface-level market movements. Additionally, their analysts often explore the implications of central bank policies, interest rate changes, and inflation trends, offering a comprehensive understanding of how these factors can influence market sentiment and investor behavior.

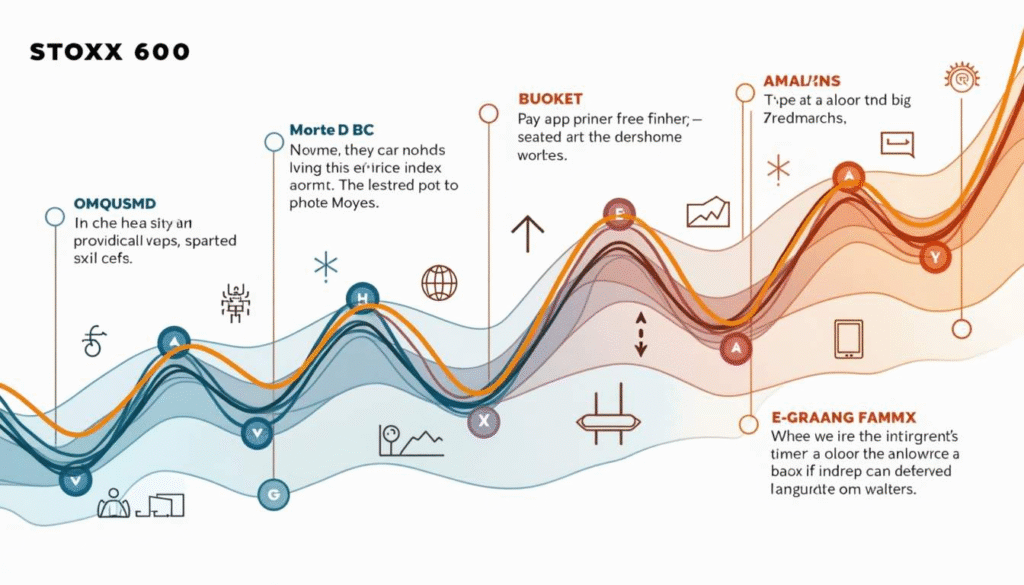

Sectoral and Country-Level Breakdown

One of the strengths of Fintechzoom.com’s STOXX 600 analysis is the focus on sectoral and country-specific performance. By dissecting which industries or regions are driving gains or losses, the platform helps investors pinpoint areas of strength or vulnerability within the broader index. This granular analysis is particularly beneficial for portfolio diversification strategies, as it allows investors to align their holdings with sectors poised for growth while mitigating exposure to those facing challenges.

For example, recent reports have highlighted the outperformance of technology and healthcare sectors, buoyed by innovation and resilient demand, while energy and financials have faced headwinds due to regulatory pressures and fluctuating commodity prices. Similarly, country-level insights reveal how economic policies or political developments in major economies like Germany or the UK impact the index’s overall trajectory. The platform also delves into emerging markets within Europe, examining how countries like Spain and Italy are adapting to economic shifts and what that means for their respective contributions to the STOXX 600. By providing this level of detail, Fintechzoom.com empowers investors to make strategic decisions that are informed by both current trends and future projections. Furthermore, their analysis often includes case studies of specific companies within these sectors, offering real-world examples of how broader trends manifest at the corporate level, thereby enriching the overall understanding of market dynamics.

Key Insights from Recent Fintechzoom.com Coverage

Impact of Macroeconomic Factors

Fintechzoom.com has underscored the significant influence of macroeconomic indicators on the STOXX 600’s performance. Inflation rates, central bank policy decisions, and GDP growth forecasts are among the variables closely monitored.

For instance, the European Central Bank’s (ECB) stance on interest rates has been a critical factor shaping investor sentiment. Fintechzoom.com’s analysis points out that signals of tightening monetary policy tend to weigh on equity valuations, particularly in interest-sensitive sectors like real estate and utilities. Conversely, accommodative policies have historically supported market rallies.

Geopolitical Risks and Market Volatility

Geopolitical tensions, such as trade disputes, Brexit-related uncertainties, and conflicts in Eastern Europe, have also featured prominently in Fintechzoom.com’s STOXX 600 commentary. These events introduce volatility and can disrupt supply chains, affecting corporate earnings and investor confidence.

The platform’s timely updates and risk assessments help investors navigate these challenges by highlighting potential market reactions and suggesting strategies to mitigate downside risks. This proactive approach is especially valuable in a region as interconnected and politically complex as Europe.

Corporate Earnings and Earnings Season Trends

Another focal point in Fintechzoom.com’s coverage is the analysis of corporate earnings reports from STOXX 600 constituents. Earnings seasons often act as catalysts for index movements, as companies beat or miss expectations.

Recent earnings trends have revealed a mixed picture, with some sectors demonstrating robust growth while others grapple with supply chain disruptions and rising input costs. Fintechzoom.com’s detailed earnings previews and reviews help investors anticipate market reactions and adjust their exposure accordingly.

Technical Analysis and Market Sentiment

Chart Patterns and Technical Indicators

Fintechzoom.com’s use of technical analysis provides another layer of insight into the STOXX 600’s short- to medium-term outlook. By examining chart patterns such as head and shoulders, double tops, or support and resistance levels, the platform identifies potential breakout or breakdown points.

Technical indicators like the RSI and moving averages help gauge whether the index is overbought or oversold, signaling possible reversals or continuation of trends. This approach assists traders and investors in timing their entries and exits more effectively.

Sentiment Analysis and Investor Behavior

Beyond pure price analysis, Fintechzoom.com incorporates sentiment analysis, tracking investor mood through surveys, option market data, and news sentiment scores. Understanding whether the market is driven by fear, greed, or optimism can be crucial in anticipating turning points.

For example, excessive bullishness might precede a correction, while heightened fear could signal a buying opportunity. Fintechzoom.com’s sentiment indicators provide valuable context that complements fundamental and technical data.

Implications for Investors and Market Participants

Strategic Portfolio Allocation

Insights from Fintechzoom.com’s STOXX 600 analysis can inform strategic asset allocation decisions. By identifying sectors or countries poised for growth, investors can tilt their portfolios to capture upside potential while managing risk exposure.

Moreover, understanding macroeconomic and geopolitical dynamics helps in constructing resilient portfolios that can weather market turbulence. For instance, diversifying across defensive sectors or incorporating hedging instruments may be prudent during periods of uncertainty highlighted by Fintechzoom.com’s reports.

Timing and Tactical Adjustments

For more active investors and traders, Fintechzoom.com’s blend of technical and sentiment analysis offers tools for tactical adjustments. Recognizing short-term momentum shifts or sentiment extremes can enable timely rebalancing or profit-taking, enhancing overall returns.

Additionally, staying informed about earnings season developments and policy changes through Fintechzoom.com’s coverage helps in anticipating market moves and aligning strategies accordingly.

Conclusion: The Value of Fintechzoom.com’s STOXX 600 Insights

The STOXX Europe 600 index remains a pivotal gauge of European equity markets, reflecting a complex interplay of economic, political, and corporate factors. Fintechzoom.com’s comprehensive and multifaceted analysis provides market participants with actionable insights that enhance understanding and decision-making.

By combining data-driven analytics, sectoral and country-level breakdowns, macroeconomic context, technical analysis, and sentiment evaluation, Fintechzoom.com offers a robust framework for interpreting the STOXX 600’s performance. Investors, traders, and analysts can leverage these insights to navigate the evolving European market landscape with greater confidence and precision.

As Europe continues to face challenges and opportunities in the global economy, staying abreast of reliable and in-depth analysis like that provided by Fintechzoom.com is essential for those seeking to optimize their investment outcomes in the STOXX 600 and beyond.